According to President Putin, Russia is able to cope with the economic sanctions imposed by the West. Vladislav Inozemtsev outlines how the Russian economy is adapting to the new circumstances.

Moscow City. Photo Anton Novoselov / Flickr

By Vladislav Inozemtsev

As the war in Ukraine is becoming ‘the new normal’, in parallel with the Western sanctions against Russia, the prospects for the Russian economy to operate under the new circumstances are brought up ever more often. Despite the energy embargo announced by the USA and Europe, the energy exports from Russia have not yet faltered significantly, the budget fill rates appear satisfactory, the rouble exchange rate is stable and inflation has come to a halt in recent weeks.

However, all these indicators have not erased the main problem: the economic recession unfolding on all fronts. The May data show that the production of all types of cars in Russia has decreased by 66.0% within the last 12 months, with electrical equipment production falling by 12.7%, wood processing by 10.7% and production of electricity, coke and oil products by 4−6%. Against this background, the inflation rate and budget surplus are not very impressive: after all, deflation and the federal treasury surplus in the USA were recorded in… 1930, when the economy was collapsing during the Great Depression.

Dependence in imported goods

On the eve of the war in Ukraine, the most important problem faced by the Russian economy was not the notorious ‘oil and gas needle’, which had been discussed by everyone since the early 2000s, but the dependence on imported goods, equipment and technologies, experienced by over 90% of all domestic companies (in Russian circumstances, money shortages can be quite easily compensated through increased domestic borrowing or additional securities issues, while lacking components and equipment cannot be replaced by anything). Russia has not produced mobile phones or computers, most office appliances and mobile network equipment, most sophisticated medical equipment (we remember domestic artificial lung ventilation machines, which repeatedly caused fatal fires) and the majority of medicines. At the same time, the equipment that was produced in Russia in partnership with foreign companies (such as modern electric locomotives and railway cars) or was localised by the latter (such as foreign car makes) has now become hostage of the mass exodus of Western corporations from the Russian market.

Finally, we should be aware that ‘import substitution’, as understood over the last eight years, has been illusory at best: Russian manufacturers were focused on ‘localisation’, i.e., on increasing the value added in Russia. This task was fulfilled quite successfully: this share recently reached 60−70% in the automotive industry against 30% in 2004. In agriculture, for instance, Russia became fully self-sufficient in sugar, but the new reality did not protect the country from the current challenges in either of these two cases. As regards the car-making industry, components such as automatic transmissions, airbags, ABS and many others have not been developed and put into production, which prevents domestic companies from assembling a modern car. Almost 100% of seeds in crop farming are imported, and such material is supplied by the global monopolists in this field (60% of the global seed market is now held by Germany’s Monsanto and Corteva from the United States), as it cannot be effectively reproduced in crop growing, which means that the dependency also looks strong here.

Circumvent the sanctions

Consequently, Russian leaders are now faced with the same problem as in 2014: they should either try to re-implement an import substitution strategy or attempt to circumvent the sanctions. Undoubtedly, the main bets are on the latter option: while Russia was actively trying to fight penetration of sanctioned imports into the country in 2014−2016, the decision to legalise parallel imports in 2022 was made swiftly, and the breadth of the items covered (hundreds of goods and component groups) leaves no doubt that imports will attempt to offer almost the same goods as before.

In my view, import substitution is unrealistic under the current circumstances because now it must be a full-cycle production (as was the case, for example, in the Soviet Union) rather than a mere increase in the value added in the country, according to the understanding prevailing in 2014−2021. This problem cannot be solved because the technologies used in the world (and in Russia) have advanced considerably, and the Russian industry itself is significantly inferior to the former Soviet industry, in both scale and capacity. Import substitution will not solve the current problems in any of the critical industries: in the best case scenario, it will trigger a sharp decline in product quality and a significant increase in costs, and in many situations matching the scale required by the national economy will be fundamentally impossible (let us recall the plans of the Russian aircraft industry). The only exception is the agricultural sector, where ‘real’ import substitution will have to be achieved in the foreseeable future at virtually any cost.

On the contrary, the prospects for parallel imports seem relatively favourable, and not only because domestic entrepreneurs are so sophisticated in pursuing illegal schemes (strictly speaking, parallel imports are not illegal, unlike, for instance, pure piracy, which is now actively practiced among Russian users of Western software products; it is likely to spread onto other intellectual property products as certain service industries, in particular the film distribution business, finally collapse), but also because many producers of imported goods are highly interested in resuming their supplies to the Russian market.

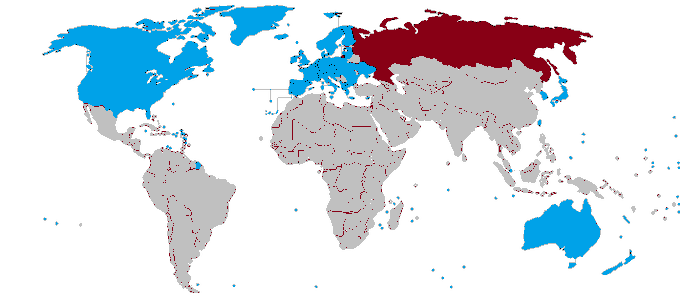

In blue: countries imposing sanctions. Graphic Twitter

In my view, the new system will work in at least three ways.

Parallel imports from Turkey

The first and the simplest method will become widespread in two cases. On the one hand, parallel imports will satisfy Russian demand for quality consumer goods (even for well-known brands): such goods were mostly produced in China and their supplies can be easily organised directly from manufacturing companies. The same applies to a whole range of high-tech goods from renowned brands, which can be purchased in various countries although their official supplies to Russia are banned. This refers to high-performance computers and other modern equipment imported in relatively small batches. On the other hand, it would be easy enough to arrange the supply of spare parts and components for household appliances, industrial equipment and even cars to Russia (all these products are already in short supply in the country and their prices are simply exorbitant in comparison with pre-war times). Such goods will be purchased in Turkey, Serbia, UAE and a number of other countries, mostly outside the Eurasian Economic Union (EAEU), and will be transported to Russia in relatively small amounts.

In my view, such trade will mainly benefit Turkey with its large market: even a 30−40% increase in orders for automotive parts from local consumers will not trigger any fears of the sanctions being circumvented. Moreover, a system of heavy goods transport from Turkey to Russia through Georgia is being actively created. Finally, Turkey accepts payment cards from Russian banks, and financial transactions with this country are now carried out almost without hindrance (recently, Ankara once again confirmed that it would not join the sanctions against Russia). Some other ‘entry points’ are quite likely to emerge as well, but at the moment I would put my money on Turkey as the main player.

The second option would apply in cases where supplier companies had no intention of leaving the Russian market, but refused to engage in official sales in Russia for fear of secondary sanctions (this applies, for example, to Chinese technology companies that depend on the policies of U.S. corporations to provide them with microchips or operating system upgrades). For instance, a number of Chinese companies are known to have stopped their supplies to Russia without any loud statements to that effect. Those which had not only sales networks but also elements of production or R&D infrastructure in the country (which is the case with Huawei, for example), shut them down and removed or dismissed the existing employees.

Willing manufacturers

At the same time, almost as soon as Russia began to talk about parallel imports, such manufacturers started looking for legal ways to return to the Russian market. The most common option that is now being used is a dramatic expansion of the dealer network in the EAEU countries, which will become a new trans‑shipment depot for supplies to Russia, allowing those players to tell their Western partners that they have ‘severed business relations’ with Russia (which, I believe, will be fully sufficient, since no one in the USA or Europe expects China to rigidly adhere to anti-Russian sanctions, and, therefore, everyone is satisfied with some routine pleasantries if, for example, military, technical and financial cooperation is suspended). The actions taken by Honor and some other Chinese companies can serve as an example of this strategy. Presumably, post-Soviet countries will be competing to ensure the best conditions for importers wanting to send goods to Russia (some Russian retail chains are known to have already started receiving goods under this scheme — the main reason why this solution is convenient is that products imported into the EAEU countries are also provided with a guarantee that is valid in Russia).

Come back of suitcase traders

The third option, and most exotic at that, will involve attempts to maintain not only a presence of products in the Russian market, but also operational manufacturing facilities in the country. This is extremely difficult for European companies: for example, tyre manufacturers Michelin and Nokian ended their operations in Russia even though most of their products were exported from that country. However, such insurmountable obstacles do not seem to exist for businesses from other countries. The example of Samsung Corporation is quite telling: it produced TV sets under its own brand as well as a fairly wide range of consumer electronics at its proprietary plant in the Kaluga Region. The plant, which has been temporarily put on halt, resumed production in June, intending to ship the entire output to Central Asian countries, and, presumably, it will be re-exported from there to Russia (most probably only on paper, I suppose).

According to the Russian Forbes analysts, this concept has a good chance of becoming highly popular in the future among companies that have not managed or wanted to sell their operating businesses in Russia (there is no doubt that the Russian authorities will assist such companies in many ‘difficult’ issues). It is also worth noting that we are seeing the emergent practice of buying Western assets among firms from ‘friendly’ countries (one example is the sale of Russian Whirlpool plants to Turkey’s Arcelik, with potential cooperation in the supply of components and equipment maintenance). Thus, the possibilities of parallel imports will probably turn out to be much more significant than might seem at first glance, and this programme is somewhat related to the rebirth of the ‘suitcase trader’ profession.

At the same time, this practice will undoubtedly face one serious problem. Since many goods cannot be purchased directly by Russian companies and citizens, and because financial settlements are complicated, there will be many intermediaries in the schemes, and the payments will most likely not correspond with the nomenclature specified in deliveries. All this will mean that a significant proportion (probably the majority) of the transactions will go against Law № 115-FZ of 7 August 2001 'On countering the legalisation (laundering) of proceeds from crime and the financing of terrorism' which, in its current version, meets the strictest requirements of European anti-money laundering legislation, and does not prescribe any such exercises.

Wait and see strategy

In other words, by legalising parallel imports, the Russian government is reviving the practices known from the first half of the 1990s, not even thinking of cancelling the regulations that were adopted during the last quarter of the century. In my view, this will lead to unprecedented confusion, constant ‘manual steering’ and, consequently, to the creation of the biggest corruption-based ‘feeding through’ for customs officers, tax officials and the Federal Financial Monitoring Service (Rosfinmonitoring). By allowing a ‘game without rules’ for business, the authorities will surely preserve the same privileges for officials, and the developments will certainly be far from boring for observers.

While parallel imports will not solve all problems for Russia, this practice fits perfectly into the ‘wait and see’ strategy adopted in difficult times (the Kremlin is still hoping that the world cannot do without Russia and that sanctions will be lifted, calculating how long the main sectors of the economy can operate with existing capacities and component stocks). Parallel imports are intended to maintain minimum consumption standards for citizens, expand opportunities for entrepreneurs and create profitable ‘feeding troughs’ for officials, none of which can be provided through import substitution.